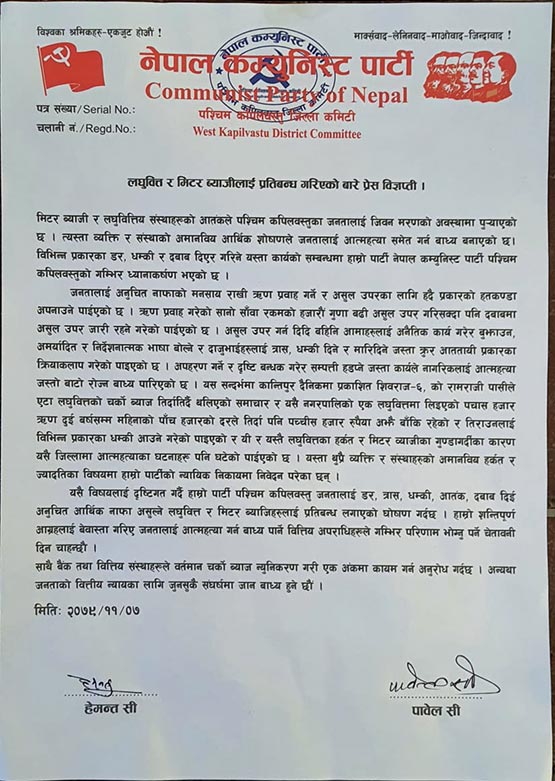

Nepal: Biplav-led CPN West Kapilvastu has banned microfinance and meter interest. According to the CPN, a press release was issued on Sunday saying that exploitation forced people to commit suicide.

The terror of meter usury and microfinance institutions have brought the people of West Kapilvastu to a life-and-death situation. “The inhuman economic exploitation of such individuals and organizations has forced people to commit suicide. Our party Nepal Communist Party Paschim Kapilvastu has drawn serious attention to such acts of fear, threats, and pressure.

Also Watch This Nepal News

It is mentioned in the statement that people are being given loans with the intention of unfair profit and that they are using extreme forms of extortion for collection. According to the party, it has been found that even after collecting thousands of times more than the small loan amount, the collection continues under pressure.

“It has been found that in order to pay the bills, the sisters and brothers used to make the mothers do immoral acts, speak unlimited and directive language, and terrorize, threaten, and kill the siblings. Acts such as kidnapping and seizing property by taking hostages have forced citizens to choose a path like suicide.

In this context, the news published in the media a few days ago that Shivraj-6’s Ram Raji Pasi was paying high interest to Eta microfinance, and the fifty thousand rupees loan taken from microfinance in this municipality was paid at the rate of five thousand per month for two years, but twenty-five thousand rupees was still remaining and it was found that there were various threats to pay it. According to the party, suicide cases have also occurred in this district due to these and similar microfinance activities and meter usury hooliganism.

In the statement, financial criminals who force people to commit suicide if their peaceful pleas are ignored will face serious consequences, and banks and financial institutions have been requested to reduce the current high-interest rate and keep it at one digit.

Ram Abatar Chaudhary

Be First to Comment